Government Pension Investment Fund Japan. Also it is a 0 risk investment option.

A Guide To The Private Retirement Scheme Prs

If one is planning to invest in mutual funds for retirement investing in equity funds is better.

. What is the amount of corpus you want at retirement if you were to retire today. Earlier pension systems in the country used to be provided only by employers ie. It is regulated by Pension Fund Regulatory Development Authority or PFRDA and any Indian national between the age of 18 and 65 can join it.

Also mutual funds shave no lock-in period making it desirable for all investors. 1800 266 7446. Since its a retirement scheme an investor cant redeem his money before the age of 60.

The Financial Industry Regulatory Authority has filed with the Securities and Exchange Commission proposed changes to FINRA Rule 3110 to allow a home office to be considered a non-branch. National Pension Scheme NPS National Pension Scheme. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia.

The returns are guaranteed in the form of monthly income payments. 78 Jalan Raja Chulan 50200 Kuala Lumpur Malaysia. We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services.

03 2022 6800 Facsimile. Moderate investors can pick flexi cap mutual funds. Single account and joint account.

A fund is a source of money that is allocated for a specific purpose. Cam How To Claim Deductions Under 80c To 80u In Itr1 Nupur Sharmas Comment Against Holy Prophet West Asian Nations Demand Public Apology From. For example if you are a conservative investor you can choose large cap schemes.

Private wealth product could become Apollos largest fund Marc Rowan. They aid in accumulating the needed corpus. They are usually managed by a firm or a limited liability partnership.

A fund can be established for any purpose whatsoever whether it is a city government setting aside money to build a new. Public Mutual Berhad 197501001842 23419-A Menara Public Bank 2 No. Schroder UK Public Private Trust plc the Company has appointed Link Fund Solutions Limited AIFM as alternative investment fund manager under AIFMD to.

Private and public employers. If your retirement goal is between 3 and 5 years away you can have part equity exposure up to 45 with 15 in gold and 40 in debt fixed income. The benefits of scale in brokerage custodial and other fees translate into.

Why investors should start SIPs in equity mutual funds for sufficient retirement corpus. In the world of fixed-income securities agency bonds represent one of the safest investments and are often compared to Treasury bonds T-bonds for their low risk and high liquidity. You need to choose mutual fund schemes based on your goals investment horizon and risk profile.

Available in units so even a small investor can benefit from its investment strategy. And while nearing the retirement age one can switch to debt funds. Make investment easy with PGIM India Mutual Fund.

Those who have a low risk appetite but want higher returns on the investments more than the PPF EPF and other similar schemes should opt for the NPS scheme and invest more in the Tier 2 account of it while maintaining the Tier 1 account. Asset include public and private fixed income public equity both fundamental and quantitative and real estate. The scheme comes with a lock-in period of 5 years.

Regulatory change could prove an opportunity for UK emerging managers. But new pension scheme introduced by the government is a flexible mode of retirement scheme in which any individual in the country can start investing towards retirement fund. By investing in it you can create a retirement corpus and also get a monthly pension for life after retirement.

Private Equity News Analysis. Mutual fund managers share their investment journey and how they dealt with bad phases in the market. Also the investors can wish to reinvest in the scheme if they want to.

If your retirement goal is more than 5 to 7 years away you can have anywhere between 45 to. Potential of return. Systematic investment plans systematic withdrawal plans dividend reinvestment.

On a whole the scheme is more secure than other high return options including the mutual funds. Post office monthly income scheme MIS is a safe investment option. The tenure Investment horizon of such funds can be anywhere between 5-10 years with an option of annual extension.

Rank Profile Total Assets Type Region. This is easily the best investment scheme in the country. Best large cap schemes to invest in 2022 Best flexi cap schemes to invest in 2022 We cant recommend any advisors.

03 2022 6900 E-mail. Social Security Trust Funds. The fund managers who identify opportunities for your investments to flourish.

A private equity fund is a collective investment scheme used for making investments in various equities and debt instruments. He is also a Trustee Director of the Schroders Retirement Benefit Scheme and is a member of its Investment Committee.

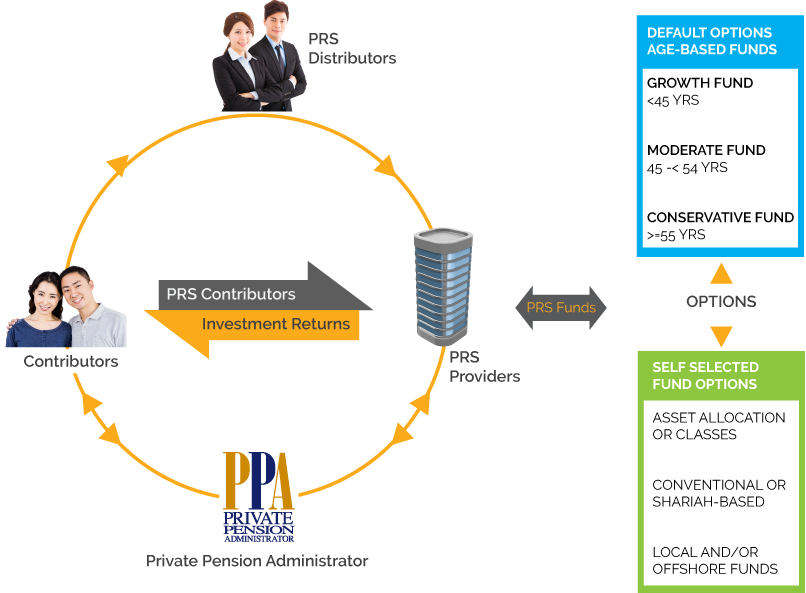

Structure Of Prs Private Pension Administrator Malaysia Ppa

Diversify Your Retirement Nest Egg

Structure Of Prs Private Pension Administrator Malaysia Ppa

Plan4invest Public Mutual Home Facebook

Prs Provider Public Mutual Berhad Private Pension Administrator Malaysia Ppa

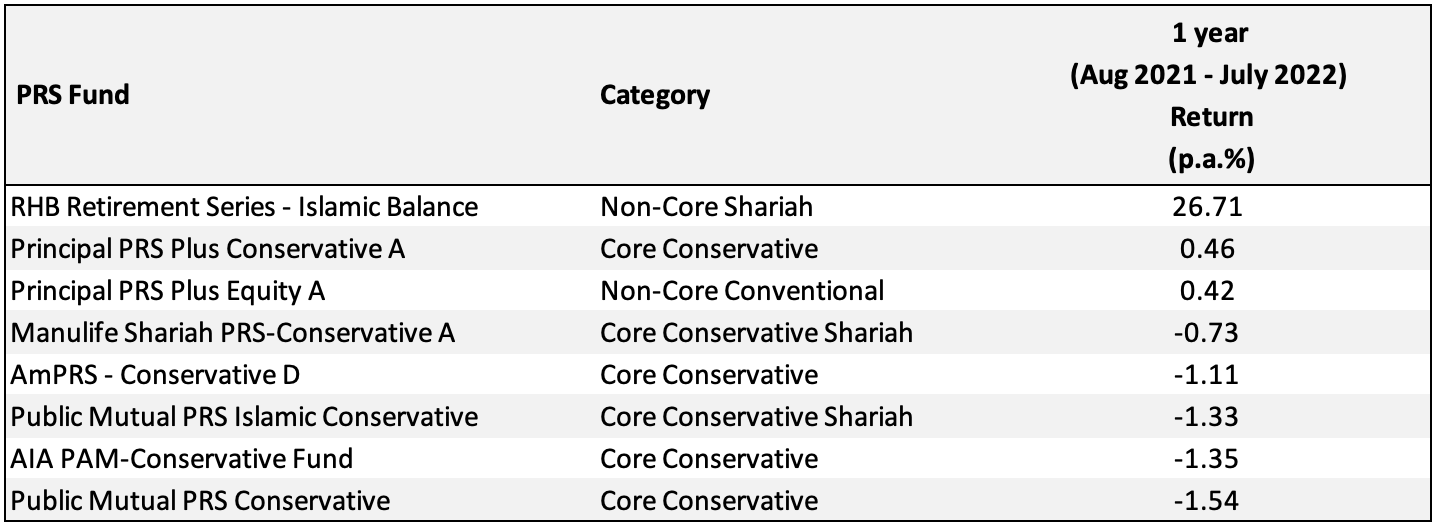

Which Prs Funds To Invest In 2020 2021 Mypf My

Awards Celebration Campaign 2022

Great New 好消息 Public Mutual Mrs Life Planner Facebook

Public Bank Berhad Unit Trust Private Retirement Scheme

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

Plan4invest Public Mutual Home Facebook

Structure Of Prs Private Pension Administrator Malaysia Ppa